|

guide/noun

someone that advises or shows the way to others and helps someone to form an opinion or make an educated decision on something. |

guide/verb

to show the way to someone or to have a direct influence on the course of action that someone may be taking. |

Fail to plan or plan to fail

They say that if you fail to plan then you plan on failing ("by Benjamin Franklin"). The best way to ensure success is to start with a "plan". Having a plan will reduce stress and ensure you don't have any regrets after the purchase. Use the "SMART" approach, which states that your results should be Specific, Measurable, Achievable, Realistic, and Timed.

Go into your purchase with the mindset that you are looking for a vehicle that will meet your overall transportation needs as compared to going out and impulsively buying a vehicle because the vehicle looks cool. Avoid purchasing a vehicle in a rush or hurry. That is when mistakes can creep into the process. Instead, take your time and be patient and use the information on this page to ensure you're considering everything before committing to the purchase. Benjamin Franklin was also credited for having said, "By failing to prepare, you are preparing to fail." Another author also put it this way, "If you're not prepared, you're unprepared."

They say that if you fail to plan then you plan on failing ("by Benjamin Franklin"). The best way to ensure success is to start with a "plan". Having a plan will reduce stress and ensure you don't have any regrets after the purchase. Use the "SMART" approach, which states that your results should be Specific, Measurable, Achievable, Realistic, and Timed.

Go into your purchase with the mindset that you are looking for a vehicle that will meet your overall transportation needs as compared to going out and impulsively buying a vehicle because the vehicle looks cool. Avoid purchasing a vehicle in a rush or hurry. That is when mistakes can creep into the process. Instead, take your time and be patient and use the information on this page to ensure you're considering everything before committing to the purchase. Benjamin Franklin was also credited for having said, "By failing to prepare, you are preparing to fail." Another author also put it this way, "If you're not prepared, you're unprepared."

|

How to be prepared

We suggest that you be prepared with the following checklist.

|

Follow a Budget

There's nothing more disappointing than finding a vehicle that you fall in love with and realizing that you can't afford it. Only you know how much you can afford and how you're going to pay for a new vehicle. The purpose of a budget is to determine the exact dollar figure you need to allocate towards the purchase of a vehicle. Start by listing your monthly expenses. Deduct your monthly expenses from your income and that differential is what you should be utilizing for your new purchase. If your expenses exceed your income then you have two choices. Reduce your expenditures or create more income. Use your differential to either save money or make payments. If you save money, the goal would be to purchase a vehicle without having to go into debt. Cash buyers always get the best terms while avoiding fees associated to debt like interest and points. Determine how much you want to save and then using your differential determine a date that you can begin looking at vehicles in that price range. If you want to own a vehicle for say $8,000. If your differential is $1,000, then you need to save for 8 months. If you don't have that time frame and you have to "finance" then use 33% or 1/3rd of your differential, in this case $333 as a maximum allowable car payment. Why? Several reasons. First, you need to save money for a Repair Savings Account. Other reasons include budgeting for ownership costs such as insurance and maintenance. Another general formula you can use to determine your monthly payment would be to stay under 15% of your gross income. If your gross household income is $4,000 per month, then your car payment should not exceed $600/mo. The problem with this formula is that your debt is not taken into consideration. The best formula for determining your maximum car payment is 33% of your differential.

There's nothing more disappointing than finding a vehicle that you fall in love with and realizing that you can't afford it. Only you know how much you can afford and how you're going to pay for a new vehicle. The purpose of a budget is to determine the exact dollar figure you need to allocate towards the purchase of a vehicle. Start by listing your monthly expenses. Deduct your monthly expenses from your income and that differential is what you should be utilizing for your new purchase. If your expenses exceed your income then you have two choices. Reduce your expenditures or create more income. Use your differential to either save money or make payments. If you save money, the goal would be to purchase a vehicle without having to go into debt. Cash buyers always get the best terms while avoiding fees associated to debt like interest and points. Determine how much you want to save and then using your differential determine a date that you can begin looking at vehicles in that price range. If you want to own a vehicle for say $8,000. If your differential is $1,000, then you need to save for 8 months. If you don't have that time frame and you have to "finance" then use 33% or 1/3rd of your differential, in this case $333 as a maximum allowable car payment. Why? Several reasons. First, you need to save money for a Repair Savings Account. Other reasons include budgeting for ownership costs such as insurance and maintenance. Another general formula you can use to determine your monthly payment would be to stay under 15% of your gross income. If your gross household income is $4,000 per month, then your car payment should not exceed $600/mo. The problem with this formula is that your debt is not taken into consideration. The best formula for determining your maximum car payment is 33% of your differential.

We can help you complete a budget which will help you identify your expenses against your income. Understanding what you can afford to save or make in payments is critical for determining how much you can spend. If you plan on financing a vehicle, be sure to make loan arrangements ahead of time this way, you will know what loan amount and terms you qualify for before you start looking at vehicles. This will save time for both you and the seller.

Financing Options

If you have to finance a vehicle, you will be going into debt and paying interest on top of the purchase of the vehicle to a lender. The interest rate on used vehicles are about 2% higher than on new vehicles because the risk associated to the loan is greater.

click here for more information on financing solutions.

If you have to finance a vehicle, you will be going into debt and paying interest on top of the purchase of the vehicle to a lender. The interest rate on used vehicles are about 2% higher than on new vehicles because the risk associated to the loan is greater.

click here for more information on financing solutions.

Setup a Repair Savings Account (RSA)

An "RSA" can provide you peace-of-mind when you need it most. A repair savings account is simply a savings account that you setup so that you have money for unexpected repairs to your vehicle. Vehicles have thousands of parts and through normal usage some of those parts may stop working. An unexpected and expensive repair is never timely and if you're not prepared with an RSA and you don't have the ability and resources to deal with mechanical challenges when they occur (and they will), then you're setting yourself up for failure. Think ahead. If your vehicle is disabled and you're not able to go to work. That will cost you money on top of frustration. Consider the peace-of-mind you would have it you have an account set aside with money allocated to repairs or a rental vehicle while your vehicle is disabled.

An "RSA" can provide you peace-of-mind when you need it most. A repair savings account is simply a savings account that you setup so that you have money for unexpected repairs to your vehicle. Vehicles have thousands of parts and through normal usage some of those parts may stop working. An unexpected and expensive repair is never timely and if you're not prepared with an RSA and you don't have the ability and resources to deal with mechanical challenges when they occur (and they will), then you're setting yourself up for failure. Think ahead. If your vehicle is disabled and you're not able to go to work. That will cost you money on top of frustration. Consider the peace-of-mind you would have it you have an account set aside with money allocated to repairs or a rental vehicle while your vehicle is disabled.

|

Know what you want in advance

We suggest keeping the process simple yet strategic. Start with three vehicle types, by year, make and model. Make sure these three choices fit your budget and over-all transportation needs. Consider the mileage and age and set parameters, i.e. you may want to consider late model vehicles with under 100k miles as they are less likely to have or develop mechanical issues. They also be may be more expensive than what your budget will allow. This is a good starting strategy to have before you start looking. Use your budget to fine-tune the mileage and year of the vehicle as you get close to a "Target-Price-Range". Once you know your target price range and have identified three general vehicle types that fit that target price range and parameters you set, then and only then do you start looking. |

Know the Value

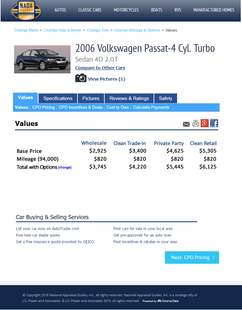

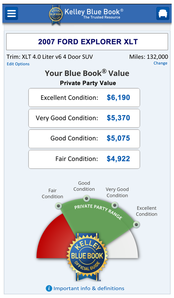

Once you've found a vehicle that is priced in your Target-Price-Range and fits the general parameters you set for yourself, now you need to know the value. Once you have the value then you can compare what the seller is asking for the vehicle to best determine the value to your budget. The BEST way to determine value is to use evaluation companies like KBB and NADA. They use extensive data on completed sales in your area when producing their values. This way, you will know exactly what you should be buying your vehicle for.

Once you've found a vehicle that is priced in your Target-Price-Range and fits the general parameters you set for yourself, now you need to know the value. Once you have the value then you can compare what the seller is asking for the vehicle to best determine the value to your budget. The BEST way to determine value is to use evaluation companies like KBB and NADA. They use extensive data on completed sales in your area when producing their values. This way, you will know exactly what you should be buying your vehicle for.

There are many companies that can help you determine the value of a vehicle. NADA-lenders determine loan to value. (KBB)-consumers/dealers, Edmunds-consumers/dealers, Black Book-dealers only

These companies specialize in assessments and pricing reports because their value-system accurately reflects what the vehicle sales are in a specific zip code. This means you can know exactly what people are paying for that same vehicle in your local area. You get up-to-date pricing with a break-down on value that is easy to understand.

Retail Value (recommended list price for a seller)

The retail value of a vehicle is typically indicative of what a seller would want to advertise their vehicle at. This is a good figure for a buyer to start with. This is the starting point for negotiating between the buyer & seller. The retail values can be separated into two categories.

The retail value of a vehicle is typically indicative of what a seller would want to advertise their vehicle at. This is a good figure for a buyer to start with. This is the starting point for negotiating between the buyer & seller. The retail values can be separated into two categories.

|

Low Retail Value

A low retail vehicle should be given to any vehicle that may have extensively visible wear and tear. The body may have dents and other blemishes. The buyer could expect to invest in bodywork and/or mechanical work. It is likely that the seats and carpets will have visible wear. The vehicle should be able to pass local inspection standards and be in safe running condition. |

Average Retail Value

An average retail vehicle should be clean and without glaring defects. Tires and glass should be in good condition. The paint should match and have a good finish. The interior should have wear in relation to the age of the vehicle. Carpet and seat upholstery should be clean, and all power options should work. The mileage should be within the acceptable range for the model year. |

Trade-in

Trade-in value is the amount one could expect to receive for a vehicle if it was being sold to a dealer when purchasing a new vehicle. There are many reasons why trade-in values are lower than retail values. One is simple: convenience. Most buyers have no interest in going through the process of selling a car. Who wants to deal with tire kickers, time wasters and having multiple meetings with complete strangers? It's much easier to walk into a dealership and leave with a new vehicle. The dealer also handles all of the paper work, meaning that the person trading in the car never has to worry about dealing with the DMV or getting an inspection or an emissions test.

Another reason trade-in values are lower than retail prices is that many trade-ins need to be reconditioned and then advertised by the dealer. Dealerships typically have to put some money into washing it, detailing it, and even fixing worn or broken items such as paint, lights, audio systems and other functions. The dealership will also have to pay for advertising the vehicle. As a result, a dealer needs to offer a trade-in value that's below the car's retail value so they can still make some money on it after the reconditioning is complete.

Trade-in values are also lower than private party prices because the dealer accepting the trade-in is giving a fictional "discount" usually because they are shifting the discount from the vehicle being purchased to the trade.

Trade-in value is the amount one could expect to receive for a vehicle if it was being sold to a dealer when purchasing a new vehicle. There are many reasons why trade-in values are lower than retail values. One is simple: convenience. Most buyers have no interest in going through the process of selling a car. Who wants to deal with tire kickers, time wasters and having multiple meetings with complete strangers? It's much easier to walk into a dealership and leave with a new vehicle. The dealer also handles all of the paper work, meaning that the person trading in the car never has to worry about dealing with the DMV or getting an inspection or an emissions test.

Another reason trade-in values are lower than retail prices is that many trade-ins need to be reconditioned and then advertised by the dealer. Dealerships typically have to put some money into washing it, detailing it, and even fixing worn or broken items such as paint, lights, audio systems and other functions. The dealership will also have to pay for advertising the vehicle. As a result, a dealer needs to offer a trade-in value that's below the car's retail value so they can still make some money on it after the reconditioning is complete.

Trade-in values are also lower than private party prices because the dealer accepting the trade-in is giving a fictional "discount" usually because they are shifting the discount from the vehicle being purchased to the trade.

Private Party

The private party value is often slightly less than the retail value because it's being sold by either a private individual or an independent used car dealer. Prices are generally lower because a private owner doesn't have overhead like a large dealership. The number one advantage of buying a vehicle from a private seller is the fact that you don't have to worry about paying any "dealer fees". A private seller is usually more eager to sell the vehicle and is typically more flexible on the price during negotiation.

The downside of buying from a private seller is that they can't offer you financing or warranties and there is no recourse if the vehicle was sold under false pretenses. Another downside to buying from a private owner is the condition and status of the vehicle. The expectation to get a lower price is diminished when buying a vehicle from a private owner who has truly taken care of a vehicle. If the private owner is proud to show you all of his/her maintenance & service records and you can visually see that they've taken care of that vehicle, the buyer can typically expect to more not less for that vehicle.

The private party value is often slightly less than the retail value because it's being sold by either a private individual or an independent used car dealer. Prices are generally lower because a private owner doesn't have overhead like a large dealership. The number one advantage of buying a vehicle from a private seller is the fact that you don't have to worry about paying any "dealer fees". A private seller is usually more eager to sell the vehicle and is typically more flexible on the price during negotiation.

The downside of buying from a private seller is that they can't offer you financing or warranties and there is no recourse if the vehicle was sold under false pretenses. Another downside to buying from a private owner is the condition and status of the vehicle. The expectation to get a lower price is diminished when buying a vehicle from a private owner who has truly taken care of a vehicle. If the private owner is proud to show you all of his/her maintenance & service records and you can visually see that they've taken care of that vehicle, the buyer can typically expect to more not less for that vehicle.

How we price our vehicles

- We produce a No Hassle, No Haggle price on each vehicle in our inventory.

- The No Hassle, No Haggle price is typically priced at or below private party value.

- We do not charge any dealer fees.

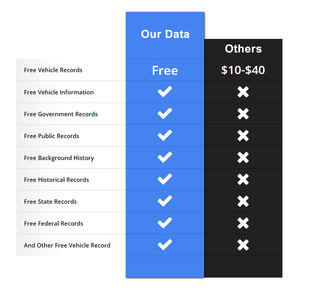

Know the history of the vehicle

One of the biggest issues consumers have when buying a used vehicle is the fear of the unknown. Sure, the paint may look nice and the seats seem comfy, but if it's been in an accident, a flood, or it has a less-than-stellar maintenance record, it could be hard to see that. That's why you have to review the history of the vehicle before you buy.

One of the biggest issues consumers have when buying a used vehicle is the fear of the unknown. Sure, the paint may look nice and the seats seem comfy, but if it's been in an accident, a flood, or it has a less-than-stellar maintenance record, it could be hard to see that. That's why you have to review the history of the vehicle before you buy.

Vehicle history reports are a combination of information from a variety of public databases. We do not add the data that you see on each vehicle. The accuracy of any information found in the data we display cannot be verified by us. There is the possibility of clerical errors made by government employees beyond our control. We cannot guarantee the completeness of the information we collect and display from third parties.

|

There are many pay-for-history sources. They usually charge anywhere from $10 to $40 to get the information on a vehicle that you are interested in. The average car buyer visits 14 different sites before buying a car. Instead of wasting time and energy searching different sites for information on a vehicle, we provide that data for FREE. We take the uncertainty and inconvenience out of the process by doing the leg work to find and post that information to our website for you.

The information on each vehicle comes from trusted sources like these.

|

|

NATIONAL MOTOR VEHICLE TITLE INFORMATION SYSTEM (NMVTIS)

The National Motor Vehicle Title Information System (NMVTIS) is designed to protect consumers from fraud and unsafe vehicles and to keep stolen vehicles from being resold. NMVTIS is also a tool that assists states and law enforcement in deterring and preventing title fraud and other crimes. Consumers can use NMVTIS to access important vehicle history information. |

Data is also found from some of the following sources. All states are required by law to report this information.

|

|

Limitations on Information & Reliance Thereupon

The information you will find on this website is provided for informational purposes only. This website and data presented are being provided only as a technology solution. Our organization does not: (i) guarantee the accuracy, completeness, or usefulness of any third-party information found on this website; or (ii) adopt, endorse, or accept responsibility for the accuracy or reliability of any opinion, advice or statement presented by a third-party on this website. Under no circumstances will our organization be responsible for any loss or damages resulting from your reliance of information or other content found on this website.

click here - NMVTIS Consumer Access Disclaimer

The information you will find on this website is provided for informational purposes only. This website and data presented are being provided only as a technology solution. Our organization does not: (i) guarantee the accuracy, completeness, or usefulness of any third-party information found on this website; or (ii) adopt, endorse, or accept responsibility for the accuracy or reliability of any opinion, advice or statement presented by a third-party on this website. Under no circumstances will our organization be responsible for any loss or damages resulting from your reliance of information or other content found on this website.

click here - NMVTIS Consumer Access Disclaimer

Know the Condition of the vehicle

The best way to know if the vehicle is in good running condition is to take it on a test-drive. Listen for unusual noises that may be associated to mechanical issues. Pay attention to whether the vehicle shifts in between gears smoothly or not. Check that the heater and air condition both work. Look at the dash for check engine lights and make sure you know what they are on for. See if the vehicle alignment is good or bad. Check the brakes to see if they are working properly. Check all the power operated devices inside the vehicle. Check the lights and make sure all the signals work.

The best way to know if the vehicle is in good running condition is to take it on a test-drive. Listen for unusual noises that may be associated to mechanical issues. Pay attention to whether the vehicle shifts in between gears smoothly or not. Check that the heater and air condition both work. Look at the dash for check engine lights and make sure you know what they are on for. See if the vehicle alignment is good or bad. Check the brakes to see if they are working properly. Check all the power operated devices inside the vehicle. Check the lights and make sure all the signals work.

Check under the hood to see how clean the engine is and if there's leaking fluids, steam or if oil is everywhere. Check the oil and make sure it's not clumpy, like it's never been changed. Check the tread on the tires and see if you're going to have to purchase new tires sooner or later and factor that into your negotiations. Take the time to look in the trunk near the spare tire for the presence of water damage or any other problematic issues. Look for mold or a damp musky smell, this could be signs of a flood vehicle. Make sure you check for rust by the door hinges and under the floor mats and under the vehicle itself. Use your nose. Do you smell gas, burning oil, or anything foul? Most importantly make sure you ask the seller if they are aware of any mechanical issues. You might be surprised by the honesty they can provide you. Once you feel you have a good grasp on the condition of the vehicle, use what you've learned in the negotiating process.

|

Know how to negotiate

Does the idea of "talking numbers" intimidate you? It shouldn't. Negotiating doesn't have to be a drawn-out, traumatic experience. The seller probably doesn't like negotiating either. If you are reasonable chances are you and the seller can make a deal quickly and easily. Even though you know your target price range already, don't start there. Make an opening offer that is lower than your target price range, but make sure it's in the ballpark based on your value assessments from TrueCar. Tell the seller that you've done your research on TrueCar and have the facts to support what you feel is a fair offer for the vehicle. If you and the seller can arrive at a price that sounds good to you and is near the private party pricing published by TrueCar, you're in good shape. |

If the seller has the vehicle priced at average retail, tell them that if they want your business they will have to be closer to private party pricing. Negotiating what's fair is fair. Avoid trying to hammer the seller down from a price that is well below retail value. If the seller has the vehicle priced right, which is any figure around private party value, then you're getting a fair price. Most private sellers don't really know how to price their vehicle, so you need to be the one to educate them on TrueCar and using the information you've gathered you can confidently make an offer that is fair to both you and the seller. There's flexible, then there's ridiculous. If the seller isn't willing to price his/her vehicle to what the market is, then don't be afraid to walk away. Make sure you're polite when you negotiate. Don't say "you're crazy" or other rude things. Use facts like "the research I have here shows that this car is worth this, and that is why I'm offering this." How can the seller argue with facts from experts that price cars for a living?